TAG Central Bank of Kenya

Alfred Keter arrested and released for alleged forgery of Treasury Bills worth Ksh 633 million

Alfred Keter, the current member of parliament for Nandi hills was arrest alongside two others for alleged forgery of Treasury 90 days Treasury Bills dated 1990. The bills in question were […]

banks / Business / World Bank

Bank interest rates have been capped in Kenya. What next?

The Banking (Amendment) Bill, 2015 was signed by President Uhuru Kenya. It will be used to cap bank lending interest rates. The banks hands will be tied in terms of how much […]

Banking technology trends

The Central Bank of Kenya through their report, Banking Supervision Annual Report 2015 indicated that over 700 bankers lost their jobs in 2015 due to technology. This is the ugly side of […]

RECENT UPDATE

Francis Atwoli response to Mohamed Fazul over COTU contributions

Below is a quote from Dr. Francis Atwoli response to Fazul, after the latter demanded that security guards should not remit their contributions to the Central Organizations of Trade Unions (COTU). The […]

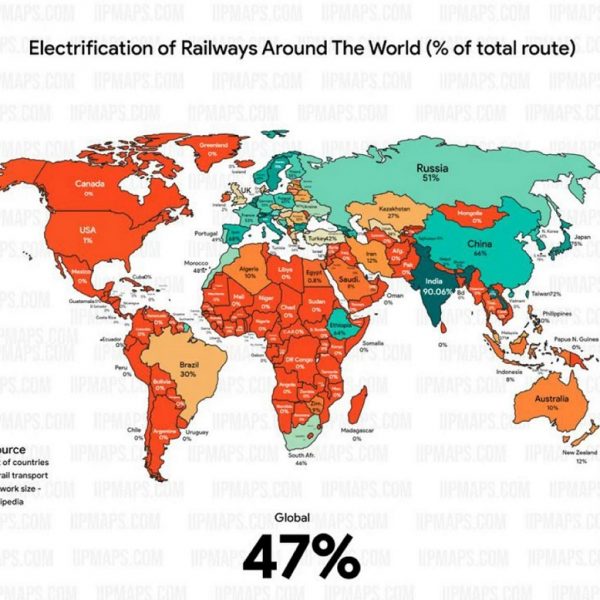

Importance of electrification of railways

Kenya has zero percent of electrified railways despite recently completing their construction of the Standard Gauge Railway (SGR) which they had a chance to electrify but chose to go for the diesel […]